Carlyle’s Global Private Equity Industrial investment team partners with large, global businesses in sub-sectors including automotive and commercial vehicles, building products, capital goods, chemicals, packaging, building products, transportation and logistics services. We leverage our deep industry expertise, vast global network, and experienced investment professionals to partner with companies to create value and achieve growth through increased investment and operational improvement.

Sector Strategy and Approach

Our long-tenured global investment team has developed industrial sub-sector specialties with specific investment themes and relationships, enabling the team to source proprietary transactions and focus efforts on compelling opportunities to identify and execute clear value creation plans for businesses.

We are highly selective, yet flexible on investment size (from $50 million to more than $1 billion), form (minority or majority), and growth stage of our partnerships, which gives us the opportunity to work with great companies regardless of their size or current capital needs. Our team has had a history of success with corporate carve-out transactions from large corporations, which are responsible for nearly two-thirds of equity invested by the global Industrial team.

Working with the executive teams of our portfolio companies, Carlyle excels in driving performance through multiple levers of value creation, including international expansion, new product development, M&A, and strategic positioning strategies. Our investment strategy is underpinned by several key themes that are driving growth in the most attractive companies within the industrial sub-sector, including:

- Migration of powertrain technologies to electric vehicles.

- Increased construction demand driven by the post-pandemic recovery.

- Acceleration of automation, electrification, and digitalization trends in production.

- Cyclical rebound of end markets driven by product innovation and shifts towards more sustainable and e-commerce driven solutions.

- Growth in global trade and increased focus on fuel efficient technologies in all parts of the supply chain.

Industrial Portfolio Companies

Carlyle has a reputation as a partner of choice for founders and management teams across the global industrial sub-sector.

Global Industrial Team

Our experienced global team includes dedicated investment professionals based in the Americas, Europe, and Asia who have extensive experience working with companies in both developed and emerging markets. We also consult with Operating Executives with extensive knowledge and significant subject-matter expertise to help build and execute upon unique value creation plans for Carlyle’s portfolio companies.

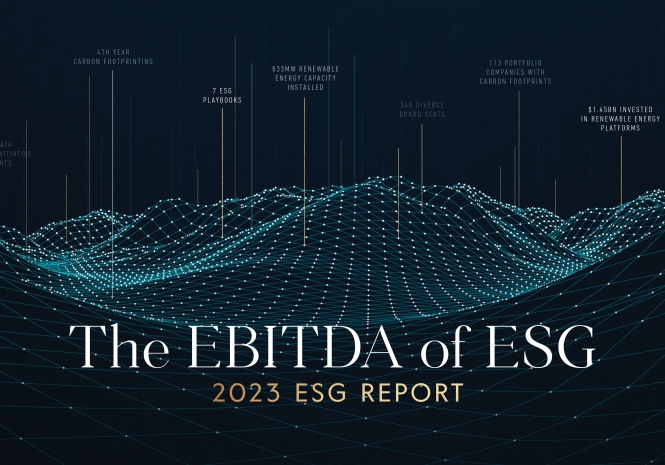

EBITDA OF ESG

We are pleased to share this year’s ESG report, entitled “The EBITDA of ESG” to reinforce our belief that integrating ESG factors into our investment processes provides an additive lens that we believe can provide opportunities for our portfolio companies to drive revenues, reduce costs, secure more efficient financing, and strengthen their competitive positioning.